Some interesting tidbits today.

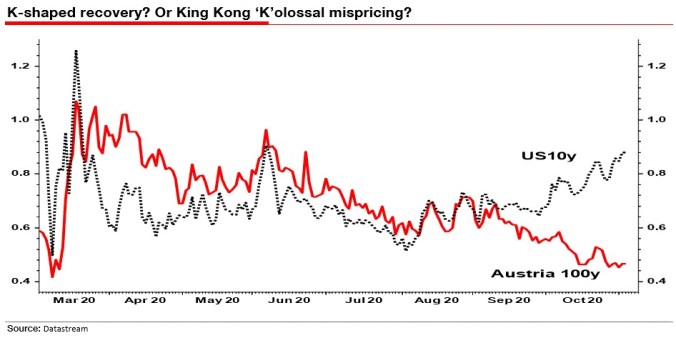

First up, a fascinating chart from Albert Edwards showing the divergence between yields for Austria’s 100-year bond which has declined from 1% to just under 0.5% while the 10 year UST yield has now started creeping towards 1%. So, let’s get this right. You lend money for 100 years to a small, fiscally sound country for a mere 40 basis points but you lend to the world’s military superpower – and default currency – and you pay more.

Next up I see that RoundHill has raised $280m, which is I think a decent result even though it was trying to raise $375m. I’m surprised that RoundHill didn’t raise over $300m given M&G acting as a cornerstone backer but my sense is that once this starts trading today I would expect this to trade at a premium of more than 10%.

Switching to emerging markets, the chart below is fascinating. It’s from Renaissance Capital and looks at Covid weekly numbers. The data coming out of Europe and now America (second/third wave) is fairly terrifying but many of the key emerging markets are beginning to look up. Note in particular the dramatic decline in India and Brazil.

Last but by no means least how about this fascinating insight around the post covid normal from hotels analysts at Morgan Stanley…

“Our surveyed corporate travel managers expect a 53% decline in ’21 travel budget spend vs ’19, weaker than our ’21 US/EU RevPAR forecasts. They also expect a 22% shift to virtual meetings from ’22 onwards. The survey leans negative, and we would hold off buying US/EU hoteliers, preferring China names

“Significant Shift to Virtual: A weighted average of corporate travel managers’ responses implies that they expect to shift 34% of travel volumes to virtual meetings in 2021 and 22% in 2022 (i.e. long term). These figures are slightly above the findings in our mid-year survey, at 31%/19% respectively. Essentially it suggests that around 1 in 5 corporate room nights could be permanently lost

“Weak 2021 Budget Outlook: 84% of companies are now allowing their workers to travel vs. 66% in our July survey. However, after a 47% expected cut in 2020 travel budgets, 2021 travel budgets are expected to be down another 12% vs. 2020, meaning a decline of 53% versus 2019. This is significantly worse than our mid-year survey showing 2021 budgets to be down 29% vs. 2019″..

Leave a Reply